Selecting an appropriate restoration method requires thorough consideration of various factors. The nature of damage and the historical significance of the component both play crucial roles. Identifying original materials and determining the item's age prove essential when deciding on restoration approaches. A detailed damage assessment - evaluating both severity and root causes - remains fundamental. Frequently, consulting with industry experts ensures chosen techniques effectively restore without causing further deterioration.

More Than Cost Reduction: Elevating Protective Measures

Cutting-Edge Driver Support Technologies

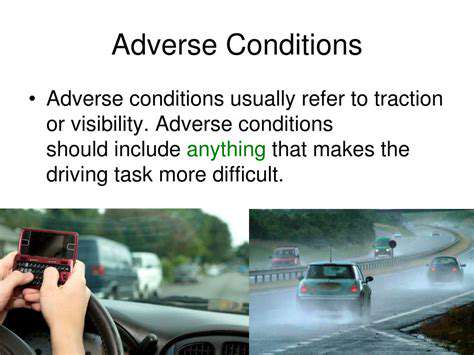

Modern driver-assistance systems, including collision avoidance alerts and lane-keeping assistance, continue evolving rapidly. These intelligent mechanisms continuously scan road conditions and vehicle surroundings, offering timely warnings and corrective actions to prevent mishaps. By significantly decreasing accident probabilities, these systems enhance overall safety, potentially reducing insurance claims and subsequent premium costs. This preventive safety strategy represents a core advantage of smart vehicle coverage, empowering motorists to better respond to road hazards.

Implementing these safety features benefits not just the primary operator but all roadway participants. Designed to predict and neutralize dangerous scenarios, these technologies create safer travel conditions collectively. The resultant safety improvement establishes more favorable insurance evaluations for conscientious drivers, as decreased accident rates correlate with fewer claims.

Anticipatory Servicing and Preventative Fixes

Smart vehicle systems enable continuous performance tracking. Collected metrics can flag developing mechanical concerns before they become serious failures. Identifying these issues early facilitates timely interventions, preventing expensive repairs and accidents stemming from equipment failures. Insurers may utilize this information to evaluate vehicle dependability, possibly offering more competitive coverage rates.

Proactive maintenance dramatically diminishes surprise repair needs by catching potential problems in their early stages. This predictive functionality offers substantial benefits by reducing both the occurrence and seriousness of automotive issues, consequently decreasing expensive repair demands. The outcome often results in more stable and predictable insurance evaluations for technology-equipped vehicle owners.

Optimized Incident Documentation and Emergency Coordination

During collisions, connected vehicle systems can automatically notify first responders, transmitting precise location data and critical details. This accelerated emergency response can prove vital for minimizing injuries and property damage. Information collected from vehicle sensors also aids in more precise accident reconstruction, potentially reducing disputes and expediting claim settlements. This enhanced reporting framework creates a more streamlined accident resolution process, benefiting both policyholders and insurers.

Comprehensive Performance Monitoring and Data Analytics

Modern vehicle insurance frequently incorporates driving behavior analysis through telematics. Evaluating driving patterns, velocity control, braking techniques, and navigation choices allows insurers to customize premiums according to individual driving styles. Cautious operators may qualify for reduced rates, while risky drivers could face higher costs. This empirical approach promotes safer driving practices and encourages responsible vehicle operation.

Insurers analyze detailed operational data to comprehend driving behaviors across various circumstances. Understanding how motorists handle diverse situations provides valuable insights into their habits. This deeper knowledge enables more precise risk evaluation, resulting in personalized premiums that accurately reflect individual driving patterns and safety records. The outcome is a customized insurance experience that acknowledges and incentivizes safe driving.

Tomorrow's Vehicle Coverage: Customized Solutions

Telematics Transformation

Driving behavior monitoring technology is dramatically reshaping auto insurance. Motorists exhibiting safe practices through telematics devices frequently qualify for discounted premiums. This data-centric method enables insurers to better evaluate risks, potentially creating more individualized and economical policies for diverse drivers. The technology promises to fundamentally transform how insurers assess and manage risk, establishing a more transparent and efficient framework.

Additionally, the system promotes safer driving by offering immediate feedback. Operators can review their patterns, pinpoint improvement areas, and potentially earn rewards for safe practices. Ultimately, this creates a beneficial cycle of improved driving standards and reduced insurance expenses for all participants.

Advanced Forecasting and Machine Learning

Insurers increasingly employ sophisticated predictive analytics and artificial intelligence to anticipate potential claims and modify premiums appropriately. Machine learning systems can process enormous datasets of driving behaviors, accident histories, and relevant variables to pinpoint high-risk individuals and vehicles. This capability allows proactive policy adjustments reflecting each driver's unique risk factors.

Tailored Coverage Solutions

The evolving insurance landscape promises increasingly customized policies designed for individual motorists. This methodology acknowledges varying risk profiles among drivers. By accounting for elements like driving records, geographic location, and vehicle specifications, insurers can develop personalized plans optimizing both coverage and pricing for specific requirements.

This individualization will likely create a fairer and more efficient insurance system for all vehicle operators.

Self-Driving Vehicles' Influence

Autonomous vehicle emergence will inevitably transform auto insurance. Providers must adjust policies to accommodate unique risks and liabilities associated with self-driving technology. Establishing responsibility in accidents involving autonomous vehicles will present complex legal challenges requiring careful examination. This progression will necessitate innovative insurance approaches and potentially new regulatory structures.

Digital Security Concerns in Smart Vehicles

Technology-dependent vehicles introduce new cybersecurity threats. Potential data breaches and system compromises could expose sensitive driver and vehicle information, possibly resulting in fraudulent claims and financial damages. Insurers must develop creative solutions to address these vulnerabilities and safeguard customers. This includes integrating cybersecurity provisions into policies and working with manufacturers to strengthen vehicle protections.

Universal Accessibility in Coverage

Future auto insurance should prioritize broader accessibility and inclusion. Existing disparities in affordable coverage availability based on economic circumstances or geographic location create substantial barriers. Providers should investigate innovative solutions to expand access, potentially through community partnerships or government programs. This inclusivity remains vital for establishing a sustainable and equitable vehicle insurance framework.