Charger Costs

The initial cost of the electric vehicle (EV) charger itself varies significantly depending on the type of charger, its features, and the brand. Level 1 chargers, typically utilizing a standard household outlet, are the most affordable option, often costing less than $100. However, these chargers offer slower charging speeds. Level 2 chargers, on the other hand, provide faster charging and typically range from $300 to $1,000, depending on the amperage and features like smart charging capabilities. Premium features, such as integrated Wi-Fi connectivity or advanced monitoring systems, will further increase the price. Choosing the right charger for your needs and budget is crucial for a smooth EV charging experience.

Installation costs also vary considerably. A basic Level 1 charger installation might only require a simple outlet modification and can be handled by a homeowner, potentially minimizing labor costs. However, more complex Level 2 installations, involving dedicated circuits and specialized equipment, will necessitate professional electrical work. The cost of professional installation typically ranges from $200 to $1,500, depending on factors like the complexity of the wiring, the location of the installation, and the need for additional electrical upgrades.

Installation Costs

Beyond the charger itself, you need to consider the cost of installation. Installation costs can vary significantly depending on the complexity of the installation, which in turn depends on factors such as the type of charger, the location of the charging station, and whether any electrical upgrades are necessary. Professional installation is often recommended for Level 2 chargers due to safety and code compliance considerations. The cost of installation can range from a few hundred dollars for a simple installation to several thousand dollars for a more complex installation requiring extensive electrical work. This cost should be considered as a significant component of the overall EV charging setup budget.

Permit Requirements

Depending on your location, obtaining the necessary permits for installing an EV charger may be a significant component of the total cost. The specific requirements and associated costs can vary greatly by municipality and state. Some areas may require a simple permit for a Level 1 charger, whereas Level 2 installations often necessitate more extensive permitting processes. This includes inspections and potentially fees associated with the permit application, which can range from a few dozen dollars to several hundred depending on the local regulations. It is crucial to research and understand the specific permit requirements in your area before starting the installation process to avoid potential delays or unexpected costs.

Permitting and Inspection Fees

While the cost of permits and inspections might seem minimal compared to the charger and installation, they're an essential part of the total cost breakdown for your EV charging setup. These fees are often overlooked, but they can significantly impact the overall budget. The cost of permits and inspections can vary greatly depending on local regulations, the type of charger being installed, and the complexity of the installation. In some areas, the fees might be relatively low, but in others, they can add a considerable amount to the overall expense. It is essential to contact your local building department or permitting office to inquire about specific regulations and fees to ensure a smooth and compliant installation process.

Financing Options and Incentives

Loan Programs for Startups

Numerous government and private loan programs are specifically designed to support startup businesses. These programs often offer favorable interest rates and flexible repayment terms, making them a valuable resource for entrepreneurs navigating the early stages of growth. Understanding the eligibility criteria and application process is crucial for maximizing the potential of these programs. Many programs prioritize startups with innovative ideas and strong business plans, recognizing that these factors contribute significantly to long-term success.

These programs frequently offer substantial financial support, enabling startups to invest in critical areas such as equipment, inventory, and workforce development. It's vital to research and compare various options to find the loan program that best aligns with your startup's specific needs and financial goals.

Government Grants and Subsidies

Government grants and subsidies can be a significant source of funding for startups, especially those focusing on research and development, environmental sustainability, or community development. These funds often do not require repayment, providing substantial capital for expansion and innovation. Navigating the application process for grants and subsidies can be complex, but the potential rewards are substantial.

Eligibility criteria often center around specific industry sectors or social impact initiatives. Thorough research into available grant opportunities and understanding the required documentation is essential for successful application.

Venture Capital and Angel Investors

Venture capital firms and angel investors play a crucial role in funding the growth of high-potential startups. These investors typically provide capital in exchange for equity in the company, allowing startups to scale rapidly and achieve significant market share. Attracting venture capital often requires a compelling business plan and a strong management team.

Securing investment from venture capitalists or angel investors can significantly accelerate a startup's growth trajectory. Thorough understanding of their investment criteria and building a strong investor pitch deck are paramount to success in attracting this type of funding.

Tax Incentives for Businesses

Numerous tax incentives exist at both the federal and state levels to encourage business development and investment. These incentives can range from deductions for capital expenditures to credits for hiring new employees. Understanding these tax incentives can directly impact a startup's bottom line and financial stability.

Taking advantage of applicable tax incentives can substantially reduce the financial burden on startups and free up resources for growth and innovation. Researching and utilizing these incentives is often overlooked but can be a significant advantage.

Crowdfunding Platforms

Crowdfunding platforms offer an alternative funding mechanism for startups, enabling them to directly engage with potential investors and customers. These platforms provide a unique opportunity to build community support and generate early adoption for products and services. Crowdfunding campaigns can be an effective way to generate capital and gain valuable market validation for new ventures.

Effective crowdfunding strategies require careful planning, compelling marketing materials, and a clear understanding of the target audience. Success on crowdfunding platforms hinges on building excitement and trust with potential backers.

Small Business Administration (SBA) Loans

The Small Business Administration (SBA) offers a variety of loan programs designed to support small businesses, including startups. These programs often feature favorable terms and can be crucial for securing necessary funding. The SBA's lending programs can be a lifesaver for startups facing financial challenges.

Navigating the SBA loan application process can be more involved, but the potential benefits and favorable terms often outweigh the challenges. Thoroughly understanding the application criteria and requirements is vital for successful loan acquisition.

Long-Term Savings and Environmental Benefits

Long-Term Savings Strategies

Long-term savings are crucial for achieving financial security and independence. Planning for the future, whether it's retirement, a down payment on a house, or funding your child's education, requires a disciplined approach. A well-structured savings plan, tailored to your individual needs and goals, is essential for maximizing returns and ensuring a comfortable future. This often involves establishing a budget, identifying areas where you can cut expenses, and consistently allocating a portion of your income towards savings. This dedication to regular savings builds a financial foundation that can weather unexpected circumstances and allow you to pursue your aspirations.

Understanding different investment options is also key to maximizing your savings. Researching various investment vehicles, such as stocks, bonds, mutual funds, and real estate, can help you determine the best approach for your risk tolerance and financial objectives. Diversifying your investments across different asset classes is a proven strategy for mitigating risk and potentially improving returns over the long term. Thorough research and consultation with financial advisors can provide valuable insights into making informed investment decisions that align with your long-term financial goals.

Environmental Considerations in Savings

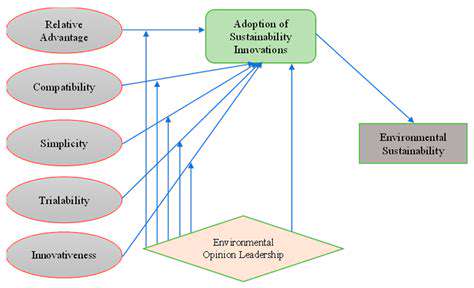

Increasingly, individuals are incorporating environmental considerations into their savings and investment strategies. This growing awareness reflects a desire to align financial decisions with sustainable practices, promoting a healthier planet for future generations. Sustainable investments, such as those in renewable energy or companies committed to environmental responsibility, can offer both financial returns and positive social impact. Researching eco-friendly investment options allows individuals to support businesses and projects with a positive environmental footprint.

Choosing environmentally conscious products and services can also contribute to sustainable savings. Making conscious purchasing decisions, such as opting for energy-efficient appliances or supporting businesses with ethical supply chains, can have a significant impact over time. By prioritizing sustainable practices in daily life, individuals can contribute to a healthier environment while simultaneously reducing long-term costs associated with resource consumption. This includes reducing consumption, reusing items whenever possible, and supporting businesses committed to environmentally responsible practices.

Evaluating the environmental impact of investments and products is an increasingly important factor for many investors. This approach considers the potential ecological damage and social inequalities that can be associated with certain financial choices. Sustainable investing not only supports a healthier planet but also often aligns with ethical values and long-term financial viability.

The consideration of environmental impact in savings decisions is becoming more crucial for individuals who want to ensure financial stability while also mitigating environmental risks and supporting a sustainable future.