Key questions emerge: Should manufacturers bear responsibility for software defects? When should owners face liability for known system vulnerabilities? These dilemmas underscore the need for comprehensive legal structures that fairly address all parties' interests.

Insurance Coverage and Autonomous Vehicles

Conventional auto insurance models prove inadequate for autonomous vehicles. The integration of AI, sensors, and complex software creates novel risk assessment challenges that insurers must address. Policy frameworks require complete overhaul to accommodate scenarios where autonomous systems fail or respond inappropriately to road conditions.

New insurance products must account for the distinctive characteristics of self-driving cars, including potential system failures and the involvement of multiple liable parties, ensuring comprehensive coverage for all accident scenarios.

The Role of Human Oversight and Intervention

As autonomous technology advances, defining appropriate human oversight levels becomes crucial. Legal standards must clearly specify when and how human operators should intervene, particularly in complex driving environments from highways to urban centers.

These guidelines must consider the vehicle's autonomy level, situational severity, and potential for human error during intervention, establishing clear legal parameters for shared control scenarios.

Ethical Considerations and Public Policy

Autonomous vehicles introduce profound ethical questions beyond traditional legal concerns. Algorithmic decision-making in life-threatening situations and potential system biases require careful policy consideration to ensure equitable technology integration.

Legal frameworks must also anticipate and prevent potential system abuses, including hacking and malicious use. Robust regulations are essential to build public trust and ensure the safe, ethical deployment of autonomous transportation solutions.

Pinpointing Responsibility: Who is at Fault?

Determining Liability in Accidents Involving Autonomous Vehicles

Assigning fault in autonomous vehicle accidents challenges traditional negligence concepts. When AI systems make critical decisions, liability assessment requires evaluating the interplay between programming, environment, and human actions.

The Role of Vehicle Programming

Autonomous vehicle algorithms fundamentally reshape liability considerations. When pre-programmed responses contribute to accidents, manufacturers face scrutiny over their design and testing processes. Legal proceedings will increasingly focus on whether systems were adequately validated for real-world unpredictability.

Human Intervention and Oversight

The liability landscape shifts dramatically based on human involvement. While human control might invoke traditional negligence standards, full autonomy transfers focus to manufacturers and programmers. Owner responsibility enters the equation when maintenance or system overrides become factors.

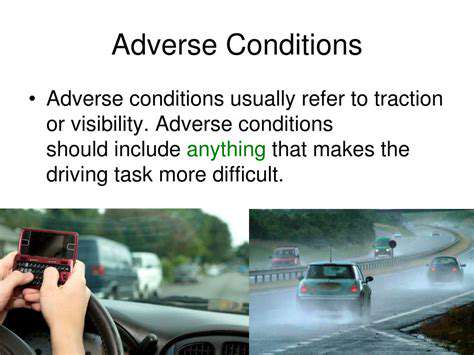

The Impact of Environmental Factors

Road conditions and weather significantly influence accident liability assessments. Manufacturers may face liability if their systems prove inadequate for common environmental conditions, making thorough testing across diverse scenarios essential for legal protection.

Data Collection and Analysis

The extensive operational data generated by autonomous vehicles provides crucial evidence for accident investigations. This digital record allows precise reconstruction of events, identifying potential system flaws, environmental contributors, and human factors in accidents.

Establishing Clear Liability Frameworks

The legal system urgently needs comprehensive liability structures addressing autonomous technology's unique characteristics. These frameworks must balance fairness for accident victims with the need to encourage continued technological innovation in the automotive sector.

The Role of Insurance Companies

Insurers must fundamentally rethink risk models for autonomous vehicles. New underwriting approaches are needed to address the complex liability landscape, including specialized coverage options and claims handling procedures for technology-related incidents.