Eligibility Criteria for the Federal EV Tax Credit

The federal EV tax credit is a powerful tool designed to encourage drivers to switch to electric vehicles. To qualify, buyers must meet several key conditions that aren't always straightforward. Missing just one requirement could cost you thousands in potential savings, making it crucial to understand every detail before signing any paperwork.

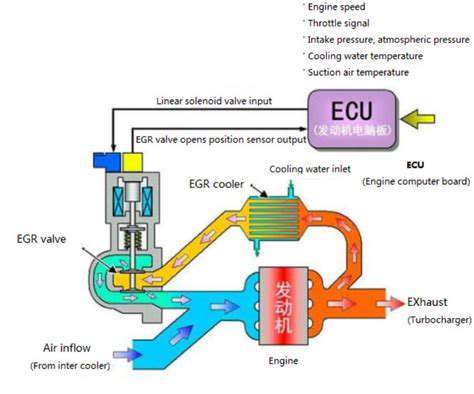

First and foremost, where your vehicle is built matters tremendously. Only models assembled in North American factories qualify for the credit. This isn't just a minor detail - it's a dealbreaker for many otherwise excellent EVs. The battery components face even stricter rules, with increasing percentages required to be sourced from North America or trade partner countries. These escalating requirements are pushing automakers to reshore their supply chains.

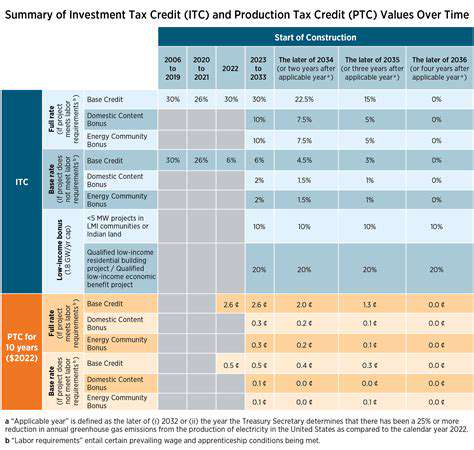

Manufacturer caps add another layer of complexity. Once a company sells 200,000 eligible vehicles, the credit begins phasing out. This creates a shifting landscape where today's qualifying model might not make the cut tomorrow. Savvy shoppers track these numbers religiously, as timing your purchase can mean the difference between a $7,500 credit and nothing at all.

Types of Electric Vehicles Eligible for the Credit

While sedans dominate the EV conversation, the tax credit actually covers a surprisingly diverse range of vehicles. From compact cars to massive electric pickups weighing over 14,000 pounds, if it plugs in, it probably qualifies. This wide net reflects how transportation electrification must address every segment to make a real environmental impact.

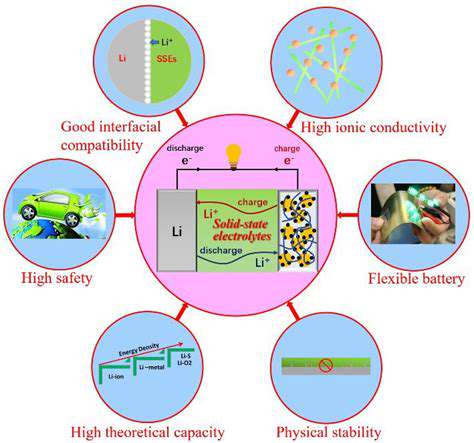

Plug-in hybrids occupy a unique middle ground, offering gas backup that eases range anxiety. Their credits are typically smaller but can be just the nudge some drivers need to take the electric leap. As battery technology improves, we're seeing these PHEVs offer increasingly impressive electric-only ranges before the gas engine kicks in.

Maximizing the Federal EV Tax Credit

Claiming the full $7,500 requires more than just buying an EV - it demands strategy. The most crucial step? Verifying your specific vehicle's VIN against current IRS eligibility lists, as trim levels and manufacturing dates can affect qualification. Dealers should provide this documentation, but wise buyers double-check everything.

Tax planning separates the savvy from the disappointed. Unlike a rebate at point of sale, this credit reduces your tax liability. Families with complex tax situations often consult professionals to ensure they can fully utilize the credit, sometimes adjusting withholdings or estimated payments to capture every dollar.

Leasing presents an interesting alternative, as the credit typically goes to the leasing company (who may pass savings via lower payments). This route sidesteps income limits and other restrictions, opening the door for more consumers to benefit from the program's incentives.

Regional Variations in EV Tax Credit Policies

State-Specific Incentives

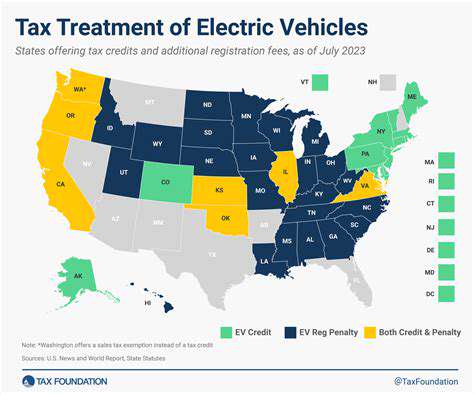

The patchwork of state incentives creates dramatic price variations across the country. California's Clean Vehicle Rebate Project offers up to $7,000 extra, while Texas provides only a $2,500 rebate - if you're lucky enough to snag one before funds run out. These programs often have waitlists, so applying immediately after purchase is critical.

Federal Tax Credits and Their Limitations

While the federal credit provides substantial savings, its phase-out mechanism creates urgency. Tesla and GM vehicles no longer qualify, with others approaching the threshold. This sunset provision forces buyers to act quickly when new models hit the market, creating boom-and-bust purchasing cycles that challenge both consumers and dealerships.

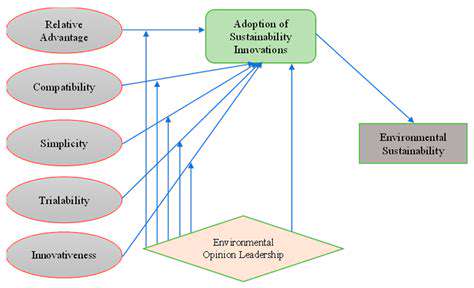

Impact on EV Adoption Rates

Data from the Department of Energy reveals stark adoption disparities. Oregon sees nearly 10% of new car sales as EVs, compared to under 1% in many rural states. This gap correlates strongly with incentive availability and charging infrastructure, highlighting how policy shapes market transformation.

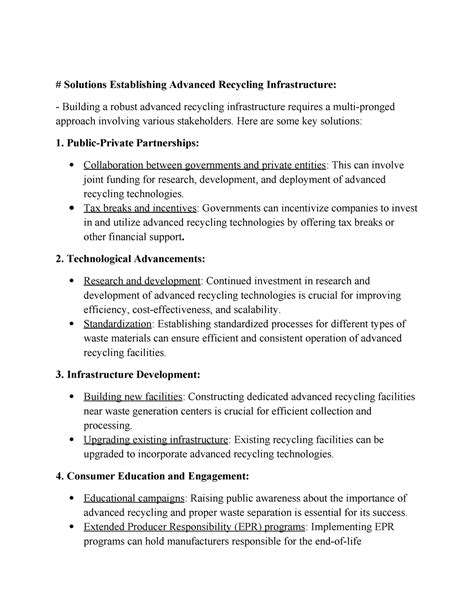

Regional Differences in Charging Infrastructure

Charging deserts still plague much of America, with entire counties lacking public stations. States like Colorado are using tax credits to fund charging installations in underserved areas, creating a virtuous cycle where infrastructure builds demand for qualifying vehicles. Forward-thinking municipalities are integrating charger requirements into building codes, ensuring new developments support electrification.

Geographic Variations in Battery Technology and Manufacturing

The Inflation Reduction Act's battery sourcing rules are reshaping the industry. States with lithium resources or battery plants (Nevada, Tennessee) are becoming EV hubs, while others scramble to attract manufacturing. This geographic shift means some regions will naturally offer better EV support as local economies become invested in the technology's success.

Important Considerations and Next Steps

Understanding Federal Tax Credits

The federal tax credit process requires careful navigation. New for 2024 is the ability to transfer the credit to dealers at point of sale - a game changer for buyers who might not have sufficient tax liability. This revolutionary option puts money in pockets immediately rather than waiting for tax season.

State-Level Incentives and Rebates

Beyond direct rebates, some states offer perks like HOV lane access, reduced registration fees, or even free charging. These secondary benefits can add thousands in value over a vehicle's lifetime. Utility companies often chip in too, with special EV charging rates or installation rebates that sweeten the deal further.

Vehicle Eligibility and Battery Capacity

The 7kWh threshold separates qualifying from non-qualifying PHEVs - a line that's moving annually. Buyers must cross-reference the IRS's frequently updated list, as even model year changes can affect eligibility. Vehicles assembled outside North America face additional battery component requirements that knock out many imports.

Documentation and Application Procedures

Paperwork missteps are the leading cause of credit delays. Required documents include the Manufacturer's Certification Letter (confirming eligibility), purchase contract showing sale date, and IRS Form 8936. Missing any item can trigger an audit or denial, making organization paramount.

Financial Planning and Budgeting

The true cost comparison requires calculating total ownership expenses. While the credit reduces purchase price, insurance, electricity, and maintenance costs all factor in. Many financial advisors now recommend running 5-year cost projections comparing EVs to gas vehicles, with the credit as one variable in a complex equation.

Staying Informed on Changes and Updates

With legislation constantly evolving, setting up alerts for IRS announcements is wise. The DOE's Alternative Fuels Data Center provides real-time updates on both federal and state programs. Subscribing to EV-focused newsletters can provide early warnings about expiring programs or newly announced incentives worth rushing to claim.