The Rise of Usage-Based Insurance

Understanding Usage-Based Insurance

Usage-based insurance (UBI) represents a significant shift in how auto insurance premiums are calculated. Rather than relying on generalized factors like ZIP codes or credit scores, this innovative model evaluates actual driving behaviors captured through real-time data collection. Modern telematics systems track multiple driving parameters including acceleration patterns, nighttime driving frequency, and hard braking incidents to create personalized risk profiles.

The fundamental advantage lies in its fairness - conscientious drivers finally receive appropriate recognition for their safe habits. This approach doesn't just adjust costs; it actively encourages better driving practices that benefit all road users through reduced accident rates.

The Technology Behind UBI

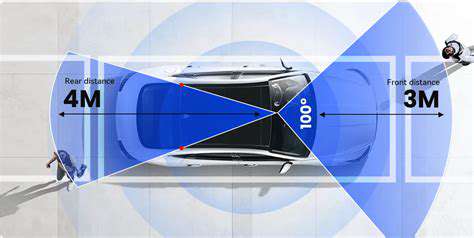

Contemporary UBI implementations utilize sophisticated onboard diagnostic (OBD) devices or smartphone applications that continuously monitor vehicle operation. These systems capture dozens of data points ranging from basic metrics like mileage to complex measurements such as g-force during turns. The collected information undergoes processing through machine learning algorithms that can distinguish between unavoidable harsh braking (avoiding an accident) and patterns of aggressive driving.

Advanced analytics transform raw telemetry into actionable insights, enabling insurers to develop dynamic pricing models that reflect actual risk rather than demographic assumptions. Some systems now incorporate weather and traffic condition data for even greater precision in their assessments.

Benefits for Insurers

Insurance providers gain multiple strategic advantages from UBI adoption. The wealth of behavioral data allows for more accurate underwriting, reducing the phenomenon of good drivers subsidizing bad ones. Claims departments benefit from precise event reconstruction capabilities when investigating accidents, often receiving automatic collision notifications with detailed pre-crash metrics.

This data-driven approach also creates opportunities for innovative product offerings. Some insurers now provide monthly driving scorecards with personalized improvement suggestions, transforming the traditional adversarial relationship into a collaborative safety partnership.

Benefits for Drivers

For consumers, the appeal goes beyond potential premium reductions. Many UBI programs offer real-time feedback through mobile apps, functioning as continuous driving coaches that highlight unsafe behaviors as they occur. Young drivers particularly benefit from this immediate reinforcement of good habits during their formative years behind the wheel.

The system's transparency represents another significant advantage. Unlike traditional models where pricing seems arbitrary, UBI participants can review exactly which behaviors affect their rates and make informed decisions about modifying their driving style.

Challenges and Considerations

Despite its advantages, UBI implementation faces several hurdles. Privacy advocates question the extent of monitoring, especially regarding location tracking outside of driving periods. The potential for algorithmic bias in risk assessment models requires ongoing scrutiny to prevent unintentional discrimination against certain driver demographics.

Technical limitations also exist - older vehicle compatibility issues, data transmission costs, and the accuracy of smartphone-based tracking compared to dedicated telematics devices all present practical challenges that insurers must address.

The Future of UBI

Emerging technologies promise to expand UBI's capabilities exponentially. Integration with autonomous vehicle systems will enable real-time adjustment of coverage based on whether the human or AI is controlling the vehicle. Blockchain applications may soon allow drivers to own and selectively share their driving data with multiple insurers for competitive quoting.

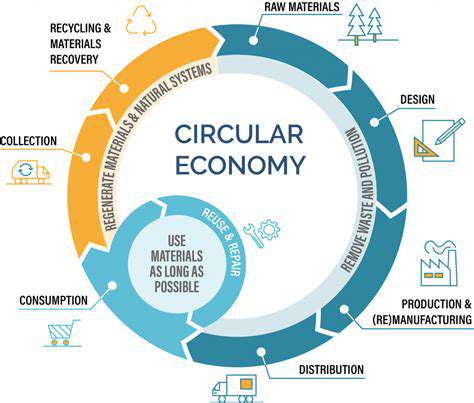

As electric vehicles proliferate, UBI systems are adapting to monitor battery health and charging patterns, potentially offering discounts for behaviors that extend battery lifespan. The convergence of these technologies suggests a future where insurance becomes a dynamic, behavior-based safety partnership rather than a static financial product.

Challenges and Future Trends

Data Security and Privacy Concerns

The extensive data collection inherent in UBI programs raises legitimate cybersecurity questions. Modern encryption standards and decentralized storage solutions are becoming essential infrastructure components. Some forward-thinking insurers now employ differential privacy techniques that maintain data utility while minimizing personal identifiability.

Regulatory frameworks continue evolving to address these concerns. The European Union's GDPR and various U.S. state laws now mandate strict protocols for data minimization, purpose limitation, and breach notification timelines that insurers must incorporate into their UBI programs.

Integration with Existing Systems and Infrastructure

Legacy insurance IT systems often struggle with the volume and velocity of telematics data. Leading providers are overcoming this through cloud-native architectures with elastic scaling capabilities that can handle peak loads during commute times. Application Programming Interfaces (APIs) now allow seamless data flow between telematics providers, claims systems, and customer portals.

The next evolution involves integrating UBI data with smart city infrastructure. Future systems may automatically adjust premiums based on route choices that avoid high-risk intersections or construction zones identified by municipal traffic management systems.

Addressing Consumer Concerns and Adoption

Transparency remains the key to consumer acceptance. Innovative insurers now provide interactive data dashboards that show exactly how each driving metric affects premium calculations. Some offer data vacations where drivers can temporarily pause certain types of monitoring while understanding the pricing implications.

The most successful implementations focus on creating value beyond just pricing. Many now incorporate gamification elements, safety score competitions among peer groups, and integration with vehicle maintenance systems that alert drivers to needed servicing based on telematics-detected symptoms.

As proof of concept, several major insurers report that their UBI customers demonstrate 10-15% better loss ratios than traditional policyholders, while participating drivers save an average of 10-30% on premiums. These measurable benefits continue driving adoption as consumers recognize the mutual advantages of behavior-based insurance models.